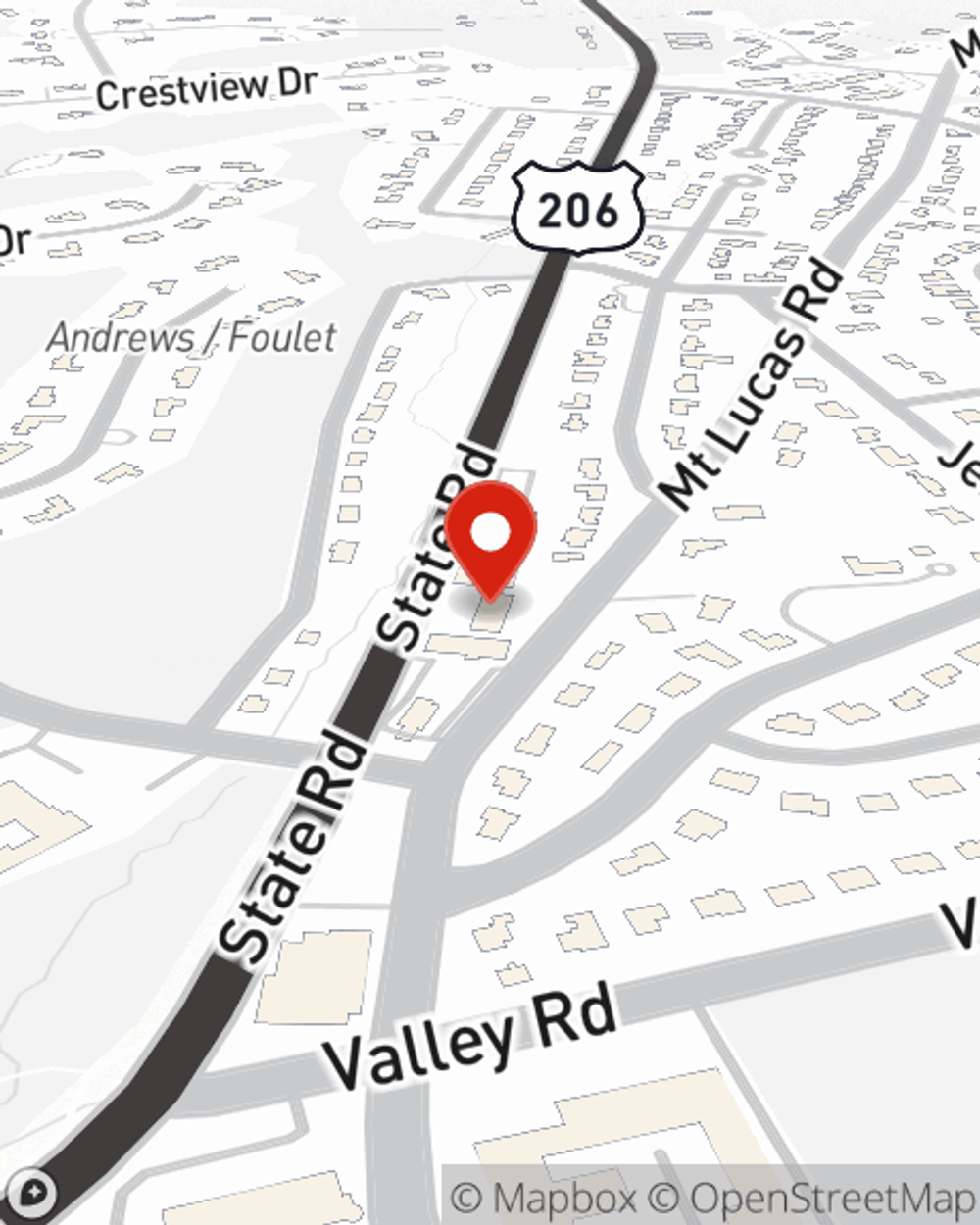

Business Insurance in and around Princeton

Princeton! Look no further for small business insurance.

Insure your business, intentionally

- Mercer County

- Middlesex County

- Somerset County

- Bucks County

- All of New Jersey

- All of Pennsylvania

State Farm Understands Small Businesses.

Preparation is key for when a problem happens on your business's property like an employee getting hurt.

Princeton! Look no further for small business insurance.

Insure your business, intentionally

Get Down To Business With State Farm

Our business plans rarely account for every worst-case scenario. Since even your most detailed plans can't predict consumer demand or product availability. In business, you can be certain of one thing: nothing is certain. That’s why it makes good sense to plan for protection with a State Farm small business policy. Business insurance is necessary for many reasons. It protects your hard work with coverage like worker's compensation for your employees and errors and omissions liability. Terrific coverage like this is why Princeton business owners choose State Farm insurance. State Farm agent Ellen Nita can help design a policy for the level of coverage you have in mind. If troubles find you, Ellen Nita can be there to help you file your claim and help your business life go right again.

Take the next step of preparation and call or email State Farm agent Ellen Nita's team. They're happy to help you research the options that may be right for you and your small business!

Simple Insights®

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

Ellen Nita

State Farm® Insurance AgentSimple Insights®

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.